SUI's Bold Claims: Can the Tech Actually Deliver?

Sui, the blockchain platform boasting "low-latency transactions with stable transaction fees," is making some pretty aggressive claims. Every crypto project promises to be the "next generation," but Sui's object-oriented design and parallelized execution are genuinely different. The question is: Does it translate to real-world performance, or is it just marketing fluff?

Understanding Sui's Core Innovation

Sui's core innovation lies in treating everything as an "object." This allows for parallel transaction processing. Instead of processing transactions serially, Sui can execute independent transactions simultaneously. They claim this leads to faster finality times, often less than half a second. That's fast, if true. But the devil is always in the details. What percentage of transactions bypass consensus? And under what network load can Sui maintain these speeds? These are the questions that matter, and the marketing material is suspiciously silent on them.

Object-Oriented Hype vs. Real-World Performance

Questioning Transaction Finality Claims

The claim that "many transactions are finalized and settled in less than half a second" is interesting, but vague. "Many" isn't a quantifiable metric. In a high-volume environment, can Sui maintain this speed for the majority of transactions, or just a select few? We need to see real-world data, stress tests, and comparisons to other blockchains under similar conditions. Otherwise, it's just marketing.

Examining Developer-Friendly Tools

Sui also touts its developer-friendly tools like zkLogin and sponsored transactions. zkLogin allows users to create accounts using familiar web logins (like Google), while sponsored transactions eliminate transaction fees for users. These are designed to lower the barriers to entry for Web3 adoption. But how secure is zkLogin, really? Relying on centralized web providers introduces new attack vectors. And who "sponsors" these transactions? If it's the developers, that model isn't sustainable at scale. (It's just a temporary subsidy.)

Regulatory Winds and Institutional Adoption

The Impact of Global Crypto Policy

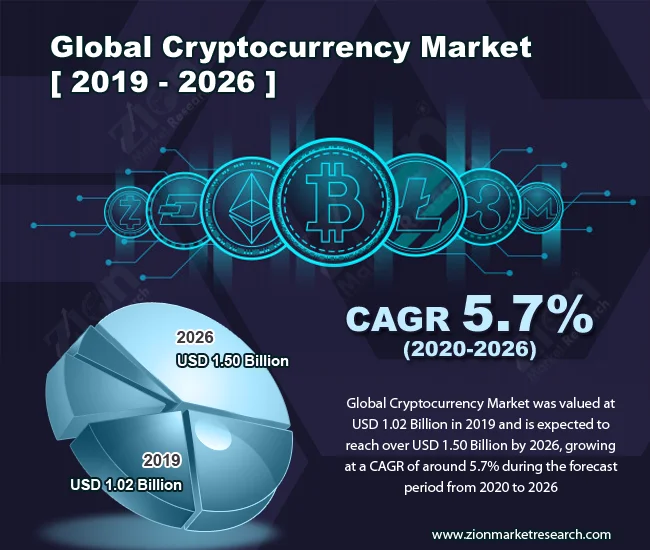

Looking beyond the tech, the broader crypto landscape is shifting. The Global Crypto Policy Review Outlook 2025/26 Report highlights a trend toward increased regulatory clarity and institutional adoption. Stablecoins are taking center stage, with over 70% of jurisdictions advancing stablecoin regulation in 2025. This is creating "major tailwinds" for institutional adoption. But regulation is a double-edged sword. While it legitimizes the space, it also introduces compliance costs and restrictions.

Stablecoins and the Future of Institutional Adoption

The US GENIUS Act, the EU's MiCA rollout, and new regimes in Hong Kong, Japan, Singapore, and the UAE, all point to a global push for stablecoin regulation. This could make stablecoins the "entry point for institutional adoption." However, the Basel Committee is reassessing its proposed prudential rules for banks' crypto exposures. (The original framework would have required full capital deductions for most crypto assets.) If regulators soften their stance on banks' engagement with digital assets, institutional momentum could continue into 2026 and beyond.

Conclusion: Sui's Potential and the Road Ahead

The Numbers Don't Tell the Whole Story

Sui's technology sounds promising, but the claims are difficult to verify without independent testing and transparent data. The broader regulatory environment is evolving, with stablecoins and institutional adoption driving market momentum. But regulation also introduces uncertainty and compliance costs. So, can Sui deliver on its promises? The jury is still out.

The Data Demands More Than Hype

The key to SUI's success isn't just its tech, but whether it can attract real users and developers. Without a thriving ecosystem, even the most innovative architecture will wither.